I worry slightly at the moment because I have built up a collection of over thirty bikes in the last twenty years but now I am trying to get down to single figures. At a rough guess that could easily be £3,000 worth of sales...enough for Mr HMRC to be interested in perhaps?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Great news. Ebay drops seller charges!

- Thread starter winjohn

- Start date

I worry slightly at the moment because I have built up a collection of over thirty bikes in the last twenty years but now I am trying to get down to single figures. At a rough guess that could easily be £3,000 worth of sales...enough for Mr HMRC to be interested in perhaps?

You’ll get a letter asking if you have anything to declare. Just reply with no. The rules have not changed, it’s just now eBay reports your sales over the threshold

bikeworkshop

Old School Grand Master

If you bought them as a hobby, and sold them off because you'd gone off them, grown up or somethingI worry slightly at the moment because I have built up a collection of over thirty bikes in the last twenty years but now I am trying to get down to single figures. At a rough guess that could easily be £3,000 worth of sales...enough for Mr HMRC to be interested in perhaps?

Your first 3,000£ is exempt, so you should be ok.

Beyond that you can offset the initial purchase cost...

Let's face it that's probably £3500

We can probably all claim a rebate!

If you did make over 3k profit selling personal collectable bikes in a year, just pay the tax

Someone needs to.

If you bought them as a hobby, and sold them off because you'd gone off them, grown up or somethingthen it's like antiques, Capital Gains Tax iirc

Your first 3,000£ is exempt, so you should be ok.

Beyond that you can offset the initial purchase cost...

Let's face it that's probably £3500

We can probably all claim a rebate!

If you did make over 3k profit selling personal collectable bikes in a year, just pay the tax

Someone needs to.

Isn’t it items £6k upwards? And you can still deduct a whole host of things.

And I’m still not sure that a bicycle would be be under Capital gains. It’s an item of limited lifespan surely which is 50 years and under same as you don’t pay it on a car.

Betsy

Old School Grand Master

A couple of years ago i bought some SimWorks pedals from Blue Lug for less than £60, i never used them, they were still in the box so put them on eBay for £85 with free UK shipping (RRP is £90 + ship in the UK) i even wrote in the listing that i bought them from Blue Lug (who offer worldwide shipping) and they're still in stock..

They sold to a guy from Poland who was very happy with them but because he'd paid for eBay to facilitate GSP the cost to him was £118.. why did he not buy them from Blue Lug or the US or even Freshtripe?

@Piotr any ideas?

They sold to a guy from Poland who was very happy with them but because he'd paid for eBay to facilitate GSP the cost to him was £118.. why did he not buy them from Blue Lug or the US or even Freshtripe?

@Piotr any ideas?

bikeworkshop

Old School Grand Master

Isn’t it items £6k upwards? And you can still deduct a whole host of things.

And I’m still not sure that a bicycle would be be under Capital gains. It’s an item of limited lifespan surely which is 50 years and under same as you don’t pay it on a car.

That's true they say 6k:

https://www.gov.uk/capital-gains-tax/allowances

Let's hope they don't think a bike collection is a single item

The digital world is going to make casual traders a lot more visible.

From my perspective that's a good thing, but it will cause headaches for a lot of genuine collectors.

LondonClassic

Retro Guru

I used to work for a company providing services to auctioneers. We would get complaints every week about the sale of Nazi memorabilia - 50% that these items were listed at all and 50% that they were in fact, fake (yes, there are folk in India and China churning out fake WW2 Nazi kit and trying to pass it off as the real deal.)Just ask ebay customer services..

Do you think it's ethical to profit from the sale of nazi memorabilia?

Ivory was the other contentious area. On both counts I saw that UK auctioneers don't lose any sleep in selling these items, I expect ebay and their under pressure business model to be no better.

bikeworkshop

Old School Grand Master

Remember this?

https://www.pocket-lint.com/apps/news/75355-ebay-listing-auction-selling-soul/

Interestingly ebay no longer allow the selling of souls as they consider them not to exist so therefore the listing is fraudulent.

So at least here they are being consistent

https://www.pocket-lint.com/apps/news/75355-ebay-listing-auction-selling-soul/

Interestingly ebay no longer allow the selling of souls as they consider them not to exist so therefore the listing is fraudulent.

So at least here they are being consistent

Twozaskars

Senior Retro Guru

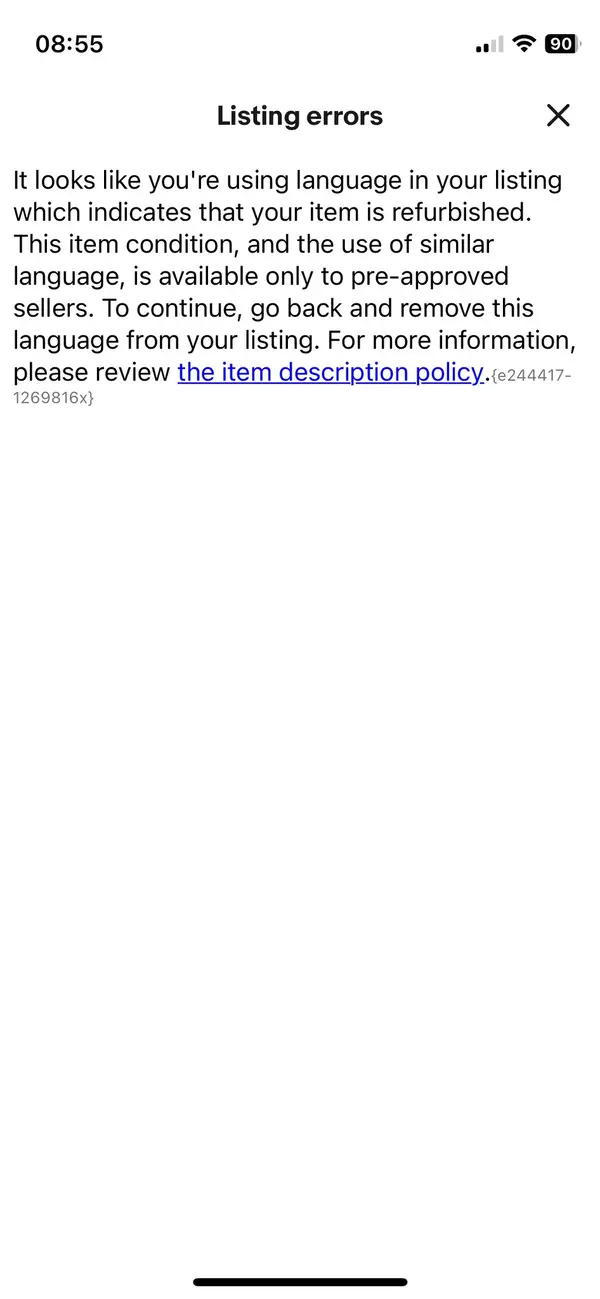

So now you need to be a 'pre-approved' seller in order to list something that's been refurbished. Good luck buying a refurbished item then selling it on. All because I want to put 'in need of refurb' in my title. Just don't use any variation of the word.

Yay, I'll throw my dog-attacked Ti flite in the bin then, or register as a business.

Yay, I'll throw my dog-attacked Ti flite in the bin then, or register as a business.

Similar threads

- Replies

- 5

- Views

- 224

- Replies

- 10

- Views

- 1K

Latest posts

-

Raw bicycles! ROAR!!! The 'naked' no paint bicycle thread

- Latest: Mark south wales

-

-

-